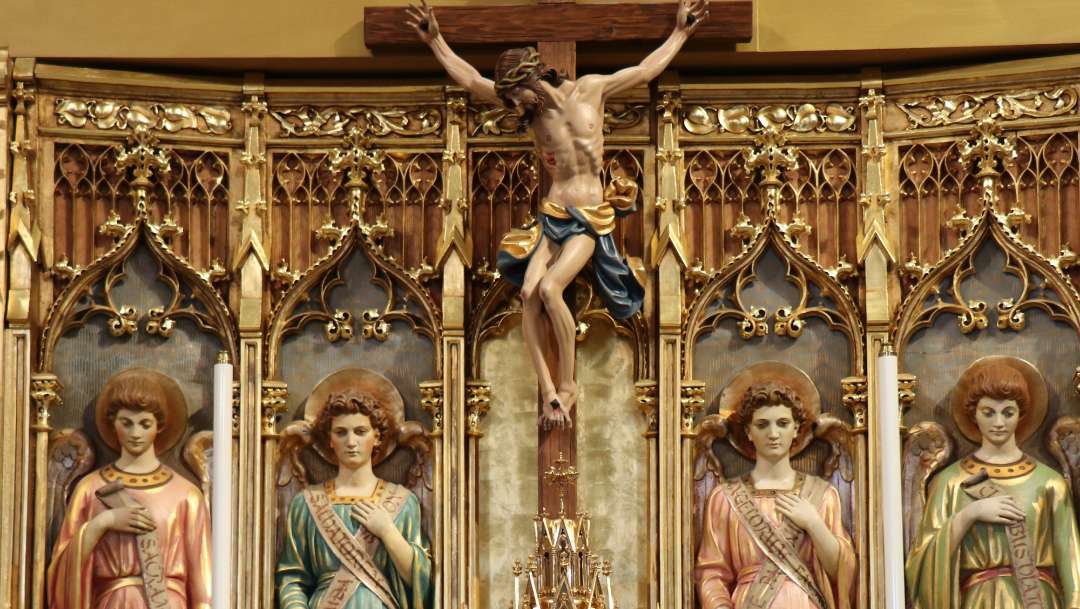

ETERNAL VALUE THROUGH

Planned Giving

HELP US CARRY OUR MISSION INTO THE FUTURE

Through Planned Giving, you help preserve the Dominican tradition and support the New Evangelization for years to come. There are a number of ways to make a planned – or legacy – gift to our community.

Did you know? We have partnered with FreeWill to provide our benefactors with a simple, intuitive tool to create a legally valid will at no charge.

Types of Planned Giving

Bequests by Will

A bequest by will is a simple way to provide for the future of the Sisters without diminishing your current assets. Your bequest may include a percentage of your estate, a certain dollar amount, or particular assets, such as real estate. If you already have a will in place, you may add the Dominican Sisters of Mary through an amendment known as a codicil.

Sample Language:

I give, devise, bequeath, __ (insert % or dollar amount) or the residue and remainder of my estate (alternately, you may specify items or property to be donated) to the Dominican Sisters of Mary, Mother of the Eucharist, Ann Arbor, MI 48105, for its general purposes. EIN:38-3349686

Beneficiary Designation

The Dominican Sisters of Mary can be named as a beneficiary for assets such as retirement plans, commercial annuities, life insurance policies, and donor advised funds. Your gift may enable your heirs to avoid paying taxes on policy proceeds at the time your estate is settled

To name the Sisters as a beneficiary, complete the appropriate plan or policy forms, or contact your financial planner for guidance on how to best structure your designation.

Charitable Remainder Trust

There are a variety of charitable trust options which may benefit the future of the Sisters. One example is a Charitable Remainder Trust, into which you make a gift of cash or other assets. From the investment of your gift, the trust provides an income to you and/or a designated beneficiary for your lifetime or for a set term of up to 20 years.

You are entitled to a charitable deduction for a portion of the value of your gift into the trust. After your estate is settled, the remainder of your trust is distributed to the Community to support the ongoing work of the Sisters. Your financial planner can help you determine what type of charitable trust may be beneficial to you.

Charitable Gift Annuity

By donating an irrevocable gift of $10,000 or more, you may enter into an agreement with the Dominican Sisters of Mary and receive a life-long fixed income, which is guaranteed regardless of market fluctuation.

CGAs offer attractive rates of return, and a portion of your CGA income is tax-exempt. CGAs are most ideal for those 70+ years of age.

IRA Qualified Charitable Distribution

For anyone age 70 ½ or older, Qualified Charitable Distribution (QCD) gifts made directly from an IRA to the Sisters may bring significant tax benefits. (QCD gifts are allowable up to $108,000 annually, or $216,000 for a married couple.)

Also known as a qualified charitable distribution (QCD), this gift option provides a tax benefit when donations are made directly from your IRA to the Sisters. Your gift can potentially reduce annual income level, Medicare premiums, and amount of Social Security subject to tax.

Contact your IRA provider to request a donation be made directly to the Sisters from your IRA.

Donor Advised Funds

A gift made from a donor advised fund (DAF) helps the Sisters live their consecrated lives and carry out the essential work of Catholic education and evangelization by putting into action the assets you have set aside for charitable purposes.

Stocks

Gifts of long-term, appreciated stock help to advance the community’s growth and work, while potentially eliminating capital gains tax liability. They may also provide an immediate tax deduction for people who itemize.

Contact your financial advisor to arrange a stock gift for the Sisters. To request stock transfer instructions, please reach us at (734) 930-4233 or plannedgiving@sistersofmary.org.

Gifts of Real Estate

A transfer of real estate can assist the Sisters for years to come. Real estate donations can provide significant tax benefits and allow people to avoid ongoing maintenance costs, property taxes and insurance expenses. Real estate can be deeded directly to the Dominican Sisters of Mary or designated as a bequest in a will or trust.

PLANNED GIVING

Learn More

To learn more about Planned Giving for the Sisters, contact us at (734) 930-4233 or plannedgiving@sistersofmary.org. Please consult your financial advisor when considering any form of planned gift.

LEAVE A LEGACY

Thanks for remembering the Sisters!

If you already have the Sisters in your legacy plans, we’d love to know. May God bless you for your generosity.